A kind of derivative contract in which there are two parties that reach an agreement to transact at a certain future date at the specified present price is known as a futures contract. There are various types of futures, generally depending upon the underlying asset. Trading in futures contract is also referred to as margin trading.

Margin trading provides a good leverage because here only 5 to 10% of the overall value of the trade contract is required as capital.

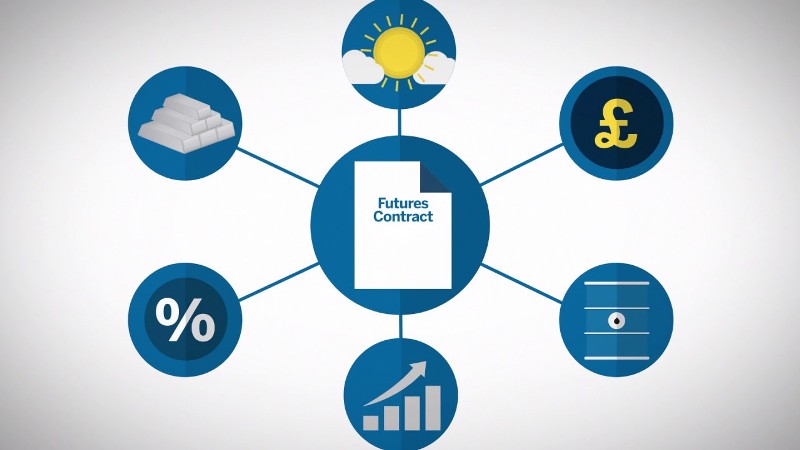

In the last few years, the futures contracts have become immensely popular and investors are now more than willing to trade in the futures contracts that provide good investment options. Following are the types of futures contracts:

- Individual stock futures

- Commodity futures

- Stock index futures

- Interest rate futures

- Currency futures

Individual Stock Futures

Individual or single stock futures (also referred to as SSF) are futures markets depending on an individual stock (for instance APA for Apache), rather than a complete stock index (for instance Dow Jones). These futures are similar to all the other futures markets, and these are traded in a similar fashion.

Individual stock futures are available for several US, European, as well as Asian stocks, and are provided through different futures exchanges, like OneChicago in the US, or the DTB (Eurex) in Europe.

In Europe as well as in Asia, the individual stock futures have been trading since a long time. However, because of some regulatory concerns, individual stock futures were offered in the US only from 2002. The Securities and Exchange Commission or SEC also poses a restriction on US traders to trade these futures which are outside the US.

Commodity Futures

Commodity futures are quite similar to the individual stock futures. In case of thiese type of futures, the underlying asset would be commodities like gold or silver. The commodity futures in India are generally traded in two different exchanges – MCX (Multi commodity exchange) and NCDEX (National commodities and derivatives exchange). The market of commodities is mainly driven by the existing demand as well as supply.

Commodity may include the following types:

- Bullion – Gold and Silver

- Metals – Aluminum, Iron, Steel, Lead, Zinc

- Cereals- Barley, Wheat, Maize

- Fiber – Cotton, Kapas

- Energy – Gasoline, electricity, natural gas

- Species – Cardamom, Turmeric

- Pulses – Chana

- Others – Potatoes, almonds, gaur, sugar

Stock Index Futures

Stock index is the underlying asset in case of these futures. For instance – the S&P CNX Nifty is commonly referred as nifty futures. These kinds of futures are helpful while speculating the regular direction of the whole market rather than the movement of a specific stock.

Stock index futures can be used for the purpose of hedging risk of a stock portfolio. Here, the movement in price of a particular stock index is been tracked. Another important feature of these types of futures is that these cannot be offered to the buyer, although they are traded similar to an asset. The settlement is always done in cash.

Interest Rate Futures

These type of futures are contracts with the underlying instrument paying interest. This type of contract happens between the buyer and seller who agree to deliver an interest-bearing asset at a future date. These types of contracts allow investors to lock the price of the interest-bearing asset slot88 for a certain future date.

The underlying instruments in case of these contracts can be:

- Treasury Bills (Treasury Bill Futures traded on CME)

- Treasury Bonds (Treasury Bond Futures traded on CBT)

- Other products like CDs and Treasury Notes

Thus there are different types of futures contracts available for traders and investors to choose from. Other than providing good returns, the main advantage of the future contracts is that they help to hedge the risk against market fluctuations and thus are attractive investment options.

Currency Futures

In case of currency futures, the price at which a particular currency will be traded in the future, that is, will be bought or sold at a future date is specified. These kinds of futures contracts help investors to hedge against the risk associated with the foreign exchange.

These contracts are marked-to-market on a daily basis, and hence investors can easily exit their specific obligation in order to buy or sell the currency before the contract’s delivery date. This is generally done by way of closing the position.

Here, the price is pre-determined at the time of signing the contract, similar to the forex market and the pair of currency is exchanged on the mentioned delivery date, which is typically in the future. However, majority of the participants in the currency markets tend to be speculators who close the positions prior to the settlement date, and hence many contracts never last till the delivery date.

Following currency futures are traded on the MCX-SX exchange:

- Euro-Indian Rupee (EURINR)

- Pound Sterling-Indian Rupee (GBPINR)

- US dollar-Indian rupee (USDINR)

- Japanese Yen-Indian Rupee (JPYINR)